Home > FAQ > french income tax on wage

french income tax on wage

French income tax is always an important item for both employee and employer. it may also be an incentive (some bonusses or reimbursment may be non taxable)

Is your employee french tax resident ?

Before paiing income tax, you first need to know if your employee is french tax resident.

Following tax treaty (link to french tax treaty – Please choose your country), your employee will be french tax resident or not, especially during first year and last year based in France

Do not hesitate to contact us to study your specific situation.

Income tax on wage and tax withdraw

Income tax on wage will apply as soon as your employee is french resident.

Starting January 2019, income tax on wage is withdrawed on french salary slip and paid by employer to french tax administration.

French tax administration communicate us a personal income tax rate for each employee.

if this personal rate is unknow , we have to deduce a withdraw calculated with an undefined rate or neutral rate.

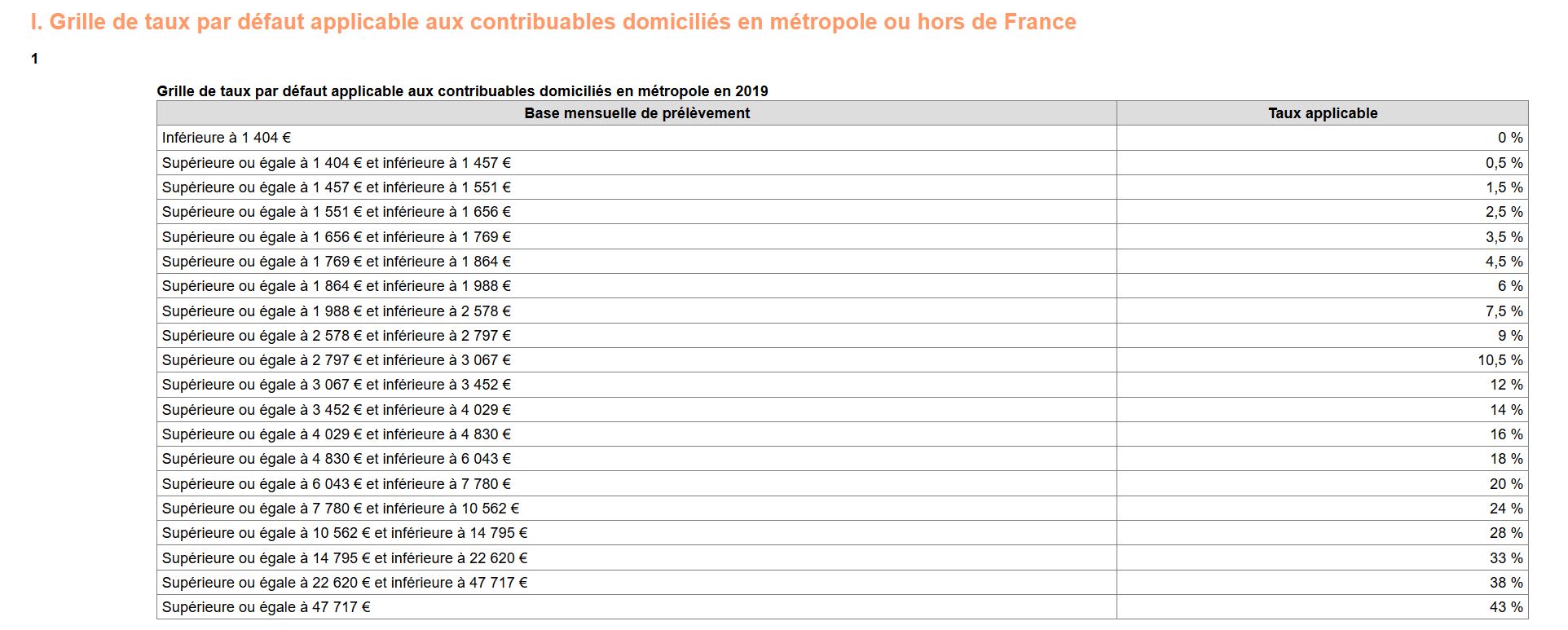

You will find below neutral rate depending on monthly wage (link to 2019 income tax neutral rates on wage)

Please note amounts below are net amount after social contributions, (it is not a gross wage amount)